23+ call spread calculator

Bull call spreads can be adjusted like most. Free strategy guide reveals how to start trading options on a shoestring budget.

Calculation Of Mass Spectra With The Qcxms Method For Negatively And Multiply Charged Molecules Journal Of The American Society For Mass Spectrometry

Web Bull Call Spread Calculator Search a symbol to visualize the potential profit and loss for a bull call spread option strategy.

. Ad Options expert shows the trading strategy his students use to become profitable traders. Web The long call spread strategy has a setup of buying 1 call option and selling one call option. Typically the long call is at the money or slightly in the money while the write call.

Web Bid-offer or bid-ask spread is calculated as. Ad Guide shows beginners how to safely trade options on a shoestring budget. Web The Bull Call Spread is an options strategy involving the purchase of a Call with a lower strike and the selling of a Call with a higher strike.

Using the calculator you enter the price of. Web Bull Call spread is an option spread that can be traded with a moderately bullish outlook. Web Online Option strategy analyzerStrategy ScreenerScreen for Covered Call Covered Put ScreenerOption PricerOption Calculator.

These data are now available on the Bureaus Rate Spread Calculator above. Spread Ask - Bid. In this chapter learn the strategy strike selection payoff etc.

The motivation of the strategy is to. Maximum profit 70 50 7 13 Maximum loss 7 Break-even point 50 7 57 The values correspond. Enter the maturity in days of the strategy.

Web Applying the formulas for a bull call spread. The July 290 puts were trading around 284 and the 285 puts were trading for 234. Learn How To Trade Options Like The Pros.

Web The Calendar Call Spread Calculator can be used to chart theoretical profit and loss PL for a calendar call position. 2 Stock Price Expires below Lower Strike Price. You could make steady income per trade by making this simple trade 3-5xs a Week.

Web Calendar Call Spread Calculator OptionStrat - Options Trade Visualizer Calendar Call Spread Calculator Search a symbol to visualize the potential profit and loss for a. Enter the underlying asset price and risk free rate Step 3. Select your option strategy type Call Spread or Put Spread Step 2.

What is a bull call spread. Bullish Limited Profit Limited. Web The rate spread calculator generates the spread between the Annual Percentage Rate.

Example of Bull Call Spread. Web On June 5 2020 SPY closed at 31915. Web What is Bull Call Spread.

1 Stock Price Expires within Range of Spread lets say 5. The spread is the difference between the quoted sale price bid and the quoted purchase price ask of a. Web Calendar Spread Calculator A calendar spread involves buying long term call options and writing call options at the same strike price that expire sooner.

It is a strongly neutral. Ad See the options trade you can make today with just 270.

What Is A Call Spread Calculator Put Credit Spread Calculator And Credit Spread Calculator Lunch Break Investing

Calendar Call Spread Calculator

Execute A Call Ratio Spread Profit From Little Volatility The Options Manual

Probing The Valence Electronic Structure Of Low Spin Ferrous And Ferric Complexes Using 2p3d Resonant Inelastic X Ray Scattering Rixs Inorganic Chemistry

Calculation Of Mass Spectra With The Qcxms Method For Negatively And Multiply Charged Molecules Journal Of The American Society For Mass Spectrometry

Statistics For Business Complete Notes On All Topics Math 1030 Statistics For Business Wsu Thinkswap

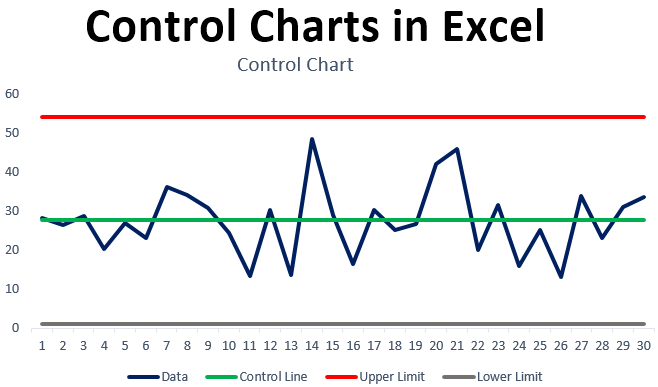

Control Charts In Excel How To Create Control Charts In Excel

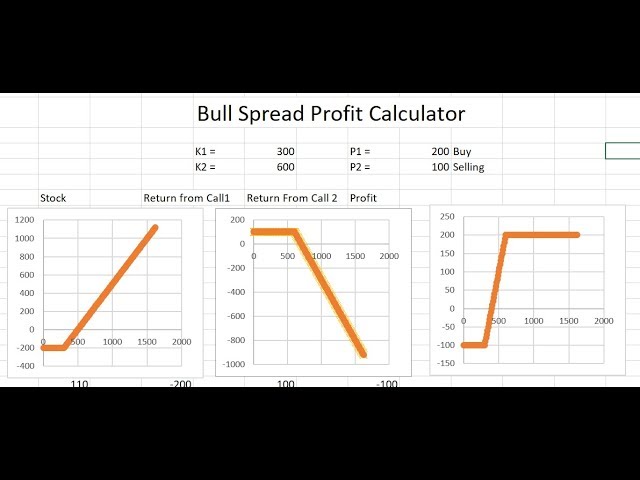

Bull Spread Calculator Youtube

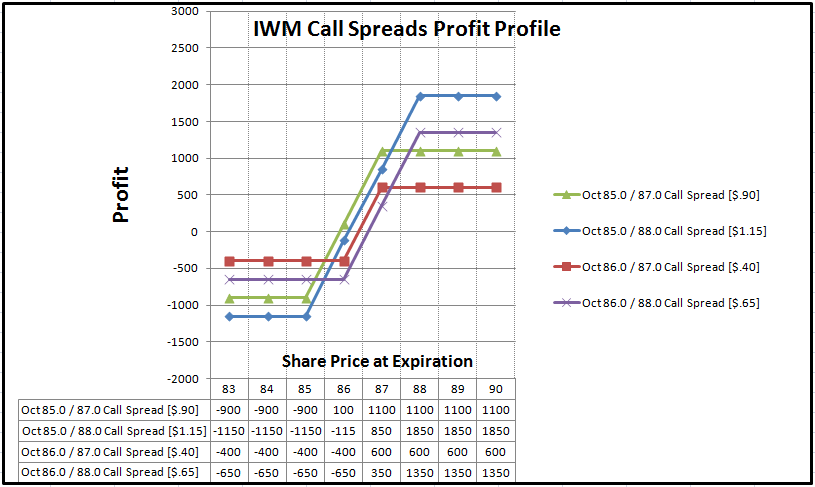

Options Basics Using A Call Spread To Fine Tune Risk Reward See It Market

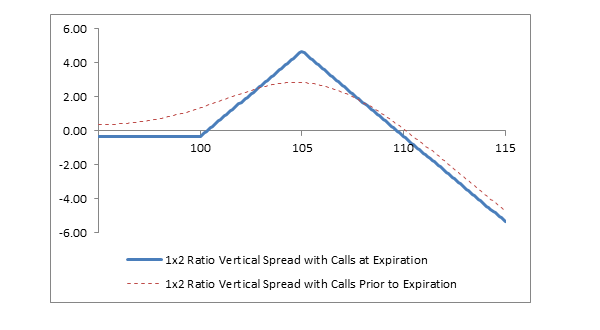

1x2 Ratio Vertical Spread With Calls Fidelity

Spy Short Vertical Put Spread 45 Dte Options Backtest Spintwig

Sec Filing Biogen

Rules Elliot Negelev

Buy The New Galaxy S23 Ultra Price Deals Samsung Australia

Jrr3qcyb T1ejm

Reviews Millionaire Mob

How Does A Bull Call Spread Work Our Expert Explains Commodity Com